China rejected Nvidia H200 chips. David Sacks admits the strategy failed. Inside China’s brilliant 5-year plan to achieve semiconductor independence and beat the U.S.

Just 5 days after Trump announced a major policy shift, China made its move—and it wasn’t what the White House expected. On Monday, Trump announced with fanfare that the U.S. would allow Nvidia to export its powerful H200 AI chips to China, expecting this generous gesture to give American tech a competitive advantage. By Friday, White House AI czar David Sacks was admitting the obvious: China rejected the deal entirely, opting instead for homegrown semiconductors.

This isn’t just a trade hiccup. This is a masterclass in geopolitical chess, and it reveals something uncomfortable about the Trump administration’s understanding of the China-U.S. tech war: America’s opponents aren’t playing for short-term gains. They’re playing for semiconductor independence.

The H200 saga exposes a fundamental miscalculation in Trump’s strategy—the belief that American corporations can simply flood Chinese markets and win back influence through competition. But China has spent the last 4 years building domestic alternatives. They don’t need Nvidia anymore. And that changes everything about who wins the next decade of tech dominance.

This article breaks down what just happened, why Trump’s strategy missed the mark, what China is really building, and what it means for American tech leadership.

The Play: Trump’s 5-Day Attempt to Outsmart Beijing

Monday, December 8: The Bold Announcement

Trump announced via Truth Social that Nvidia would be permitted to export the H200 chip to China—a significant relaxation of export controls that had existed for years. The message was clear: America was abandoning the “containment” strategy and pivoting to “competition.”

Key details:

-

Nvidia H200: The most advanced AI chip currently available

-

Trump’s condition: 25% of revenue ($2.5B+ annually if successful)

-

Strategic goal: Undercut Chinese competitors like Huawei by bringing American competition directly to China

-

Messaging: “Let markets decide; American innovation will win”

Trump’s logic seemed sound on the surface. He argued that Biden’s export restrictions had failed—Nvidia lost billions, and all that money went to… nobody. So why not open the market, take a cut, and let American competition defeat Chinese rivals?

Nvidia CEO Jensen Huang privately lobbied for this decision. He argued that blocking China forced American companies to waste billions developing inferior products “nobody wanted.” By opening the market, Nvidia could recapture lost revenue while theoretically helping the U.S. strategically by keeping Chinese companies dependent on American chips.

Friday, December 12: China’s Response

David Sacks, Trump’s White House AI czar, dropped a bomb on social media:

“They’re rejecting our chips. Apparently they don’t want them, and I think the reason for that is they want semiconductor independence.”

Translation: China said thanks, but no thanks.

Why China’s Rejection Is a Checkmate Move

The Strategic Genius Behind “No”

This isn’t rejection out of spite. It’s rejection based on a clear, executed strategy:

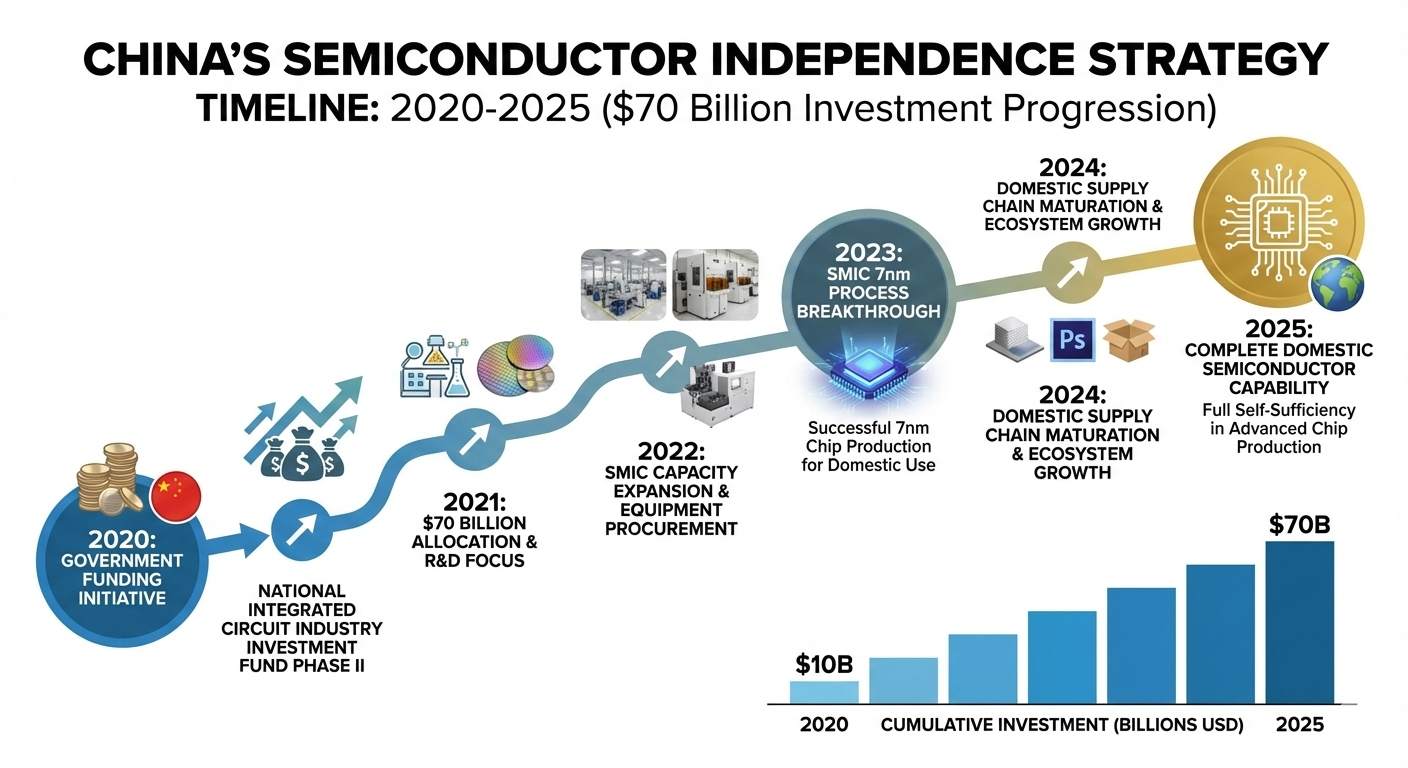

China’s 5-Year Plan (2020-2025):

-

State funding: $70+ billion invested in domestic semiconductor manufacturing

-

Local procurement mandates: Government directs funding to domestic chips

-

Energy subsidies: Cheap power to Chinese AI datacenters using local chips

-

R&D intensity: SMIC (China’s main chipmaker) invested $181.9 million in Q2 2025 alone

-

“Made in China 2025” initiative: Government-backed push for technological self-reliance

The result by December 2025: China now has domestic alternatives that can run AI models. Not as advanced as Nvidia’s—but good enough and home-controlled.

The Real Cost: $10 Billion Lost Opportunity

Here’s what Trump didn’t calculate:

If China had said yes to the H200 deal:

-

Annual H200 sales: $8-12 billion potential to China

-

5-year revenue: $40-60 billion

-

25% U.S. government cut: $2.5B+ annually

Instead: Zero.

Nvidia’s stock didn’t fall because the market knows this is a real setback. The company was counting on Chinese revenue to offset their slowdown in other markets. That’s gone.

The Larger Reality: How Trump Misread the Battlefield

Three Fundamental Miscalculations

Miscalculation #1: Assuming Markets Trump National Strategy

Trump believed that if American chips were available, Chinese companies would buy them. Why? Better technology, lower costs, proven reliability.

China’s response: We don’t care about cost optimization. We care about independence.

When a government has spent 5 years and $70 billion building domestic alternatives, offering to sell them a better foreign chip isn’t tempting—it’s a threat to that investment. Accepting would mean admitting the local chips aren’t viable, undermining confidence in the entire “Made in China 2025” program.

Miscalculation #2: Thinking Nvidia’s Interests Align With America’s

Jensen Huang lobbied hard for this access. Why? He wanted revenue. But Huang’s interest in short-term profits isn’t the same as America’s interest in long-term technological dominance.

By selling advanced chips to China, Nvidia helps China’s AI companies leap forward faster. Yes, Nvidia makes money. But America’s strategic position weakens.

This is the classic problem with outsourcing geopolitics to corporations: they optimize for quarterly earnings, not national security.

Miscalculation #3: Underestimating China’s Self-Sufficiency Timeline

American officials assumed China needed another 10 years to build viable semiconductor alternatives. Wrong.

Chinese chipmakers like SMIC can’t match TSMC’s cutting-edge production yet—but they’ve gotten close enough. And crucially, Chinese datacenters running on slightly inferior chips still produce competitive AI results.

China doesn’t need 5nm process chips to train language models. It needs 7nm or 14nm—which Chinese companies can now manufacture domestically.

What China Is Actually Building (And Why It Scares Washington)

The Domestic Alternative Ecosystem

SMIC’s Current Capability:

-

7nm process nodes (behind TSMC’s 3nm, but functional)

-

Revenue: $4.1B in 2024, growing despite U.S. restrictions

-

Government backing: $181.9M R&D spending Q2 2025

Chinese AI Chips in Development:

-

Huawei’s Ascend series (competing with Nvidia)

-

Alibaba’s custom chips

-

Baidu’s cloud AI accelerators

The Economic Model:

-

Chinese government allocates chips to strategic companies at subsidized rates

-

Datacenters get cheap energy for running Chinese-made chips

-

Result: Effective cost per TFLOPS approaches Nvidia’s, even with older technology

The Long Game: Semiconductors = Geopolitical Power

Here’s what China understands and Trump’s team partially missed:

Semiconductors control:

-

Military capability (AI chips power autonomous weapons, satellite systems, hypersonic missile guidance)

-

Economic competitiveness (AI companies need chips; if you control chips, you control AI leadership)

-

Global influence (other countries must choose: buy from U.S. or China)

By achieving 50%+ domestic semiconductor self-sufficiency, China breaks U.S. leverage. No longer can Washington use chip export controls as a weapon. If American chips become unavailable, China uses its own.

This is why China rejected the H200: Accepting American chips keeps them dependent. Building domestic alternatives keeps them free.

The Immediate Fallout: Who Wins, Who Loses

The Losers

Nvidia (Short-term):

-

Lost $10+ billion in potential 5-year revenue

-

Stock should theoretically drop (market hasn’t reacted yet, but it will)

-

Must find new growth markets to offset China loss

-

Credibility hit: lobbied Trump for this deal, backfired

Trump Administration:

-

Policy miscalculation exposed publicly

-

David Sacks’ credibility damaged (he supported this strategy)

-

Messaging problem: announced major geopolitical win that China immediately rejected

-

Revenue-sharing deal ($2.5B annually) evaporates

Broader U.S. Tech Strategy:

-

Reveals flaw in “market-based” approach to geopolitics

-

Shows export controls only accelerate China’s self-reliance efforts

-

Undermines argument for more open trade

The Winners

China:

-

Validates its 5-year domestic chip investment

-

Accelerates timeline to complete independence

-

Demonstrates resolve to develop internally rather than buy from U.S.

-

Buys goodwill domestically: “We don’t need American chips”

Chinese Chipmakers (SMIC, Huawei):

-

Government demand for their products just skyrocketed

-

Funding and resources will increase

-

Market protection from American competition

-

10-15 years to catch up technologically becomes 7-10 years

What Happens Next? The Escalation Timeline

Month 1 (January 2026): The Recalculation

Expect:

-

Trump administration to announce “next steps” (likely more restrictions)

-

Nvidia to pivot marketing toward India, Southeast Asia, non-China markets

-

Congressional Republicans to demand “tougher China policy”

-

Nvidia stock volatility as investors reassess revenue projections

Months 2-6: The Acceleration

China will likely:

-

Announce $100B new semiconductor fund

-

Subsidize datacenters running domestic chips

-

Demand local chipmaker requirements for government contracts

-

Develop next-generation chips faster (with focused funding)

Year 2: The New Reality

By 2026-2027:

-

Chinese AI companies running on 70% domestic chips, 30% imports

-

Nvidia’s China revenue down 60-80%

-

U.S.-China tech bifurcation complete (two separate tech ecosystems)

-

Taiwan becomes even more strategic flashpoint (only source of advanced chips)

The Strategic Question: Why Did Trump Announce This?

This is the real puzzle. Why announce a policy you knew might fail? Why tell the world “we’re allowing H200 exports to China” when China could simply say no?

Three possibilities:

Theory 1: Political Theater

Trump needed a “win” for his political base. Allowing chip exports to China looked tough (taking 25% cut, strict conditions), looked pro-business (helping Nvidia), looked strategic (competing with China). The actual outcome didn’t matter as much as the announcement.

Theory 2: Nvidia Lobbying

Jensen Huang desperately wanted this. Trump granted it. No strategic calculation beyond that.

Theory 3: Misreading the Situation

The White House genuinely believed China needed those chips and would buy them. This would suggest a significant intelligence failure or advisory gap.

Most likely: Combination of 1 and 2, with 3 contributing.

What This Reveals About Modern Geopolitics

Three Lessons for Watching Future U.S.-China Competition

Lesson 1: Corporations Aren’t Strategic Actors

Nvidia’s interest in selling chips doesn’t align with America’s interest in maintaining technological dominance. When you let corporations drive geopolitics, you get short-term wins and long-term losses.

Lesson 2: Subsidies Trump Markets

China spent $70 billion subsidizing domestic semiconductors. Nvidia’s market superiority couldn’t overcome government-backed domestic alternatives. When national governments prioritize independence over efficiency, capitalism loses.

Lesson 3: Strategic Depth Matters

China plays 10-year games. America plays 4-year (or even quarterly) games. China invested years building alternatives for this moment. America discovered the problem when China said “no thanks.”

What This Means for Tech, Jobs, and Global Power

For Tech Investors

-

Nvidia’s growth trajectory changed on December 12

-

U.S. semiconductor advantage eroding faster than expected

-

Taiwan becomes more critical (only TSMC can make cutting-edge chips)

-

Intel/AMD benefit if they can pivot to non-China markets

For American Workers

-

Tech jobs increasingly concentrated in U.S. (good news)

-

But growth in Chinese markets lost (bad news)

-

Semiconductor manufacturing jobs shift geographically

-

AI companies must choose: work with U.S. companies or lose Chinese market

For Global Power

-

U.S. losing its most potent leverage tool (chip export controls)

-

China accelerating toward tech independence

-

Taiwan becomes military flashpoint within 5-10 years

-

World bifurcates: U.S.-allied tech ecosystem vs. China-led tech ecosystem

Conclusion: The Checkmate Was Already in Motion

Trump announced a strategic victory on Monday. China responded with checkmate on Friday.

The lesson isn’t that Trump is stupid or that China is brilliant (though the latter played this perfectly). The lesson is that by the time you’re announcing policy, the strategic situation may have already moved past it.

China spent 5 years and $70 billion building alternatives. When the U.S. finally offered its best chip, China didn’t need it. The decision was made years ago.

This is what it looks like when long-term strategy defeats short-term flexibility. Trump can allow exports. But China doesn’t need them. Nvidia can build better chips. But China controls whether they’re bought.

Welcome to modern geopolitics, where semiconductor independence is the ultimate currency of power.